The Investor Education and Protection Fund Authority Appointment of Chairperson and Members Holding Meetings and Provision for Offices and Officers Rules. And for connected purposes.

Transfer of Ordinary Shares to the Investor Education and Protection Fund.

. Based on the Board recommendation in May 2016 Final dividend for the year 2015-16 was declared in the. 0602 AM Pacific Premier Bancorp PPBI Declares 033 Quarterly Dividend. By giving notice in writing and delivered to the registered office of the company.

To make other provision relating to companies and other forms of business organisation. To make provision about directors disqualification business names auditors and actuaries. Of Model Articles of Company Limited by shares as Contained in Table-F of Schedule-I of the 2013 Act.

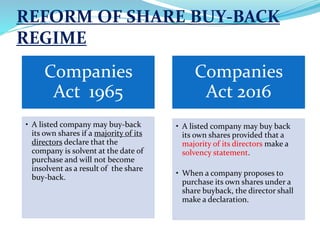

Pursuant to the provisions of Section 1246 of the Companies Act 2013 read with the Investor Education and Protection Fund Authority Accounting Audit Transfer and Refund Rules 2016 Ordinary Shares of the Company in respect of which dividend entitlements have remained unclaimed for seven. The Companies Act 2016 CA 2016 repealed the Companies Act 1965 CA 1965 and changed the landscape of company law in Malaysia. Download complete list of Chapters and Topic wise all Sections of Companies Act 2013 as amended by the Companies Amendment Act 2020 in PDF format.

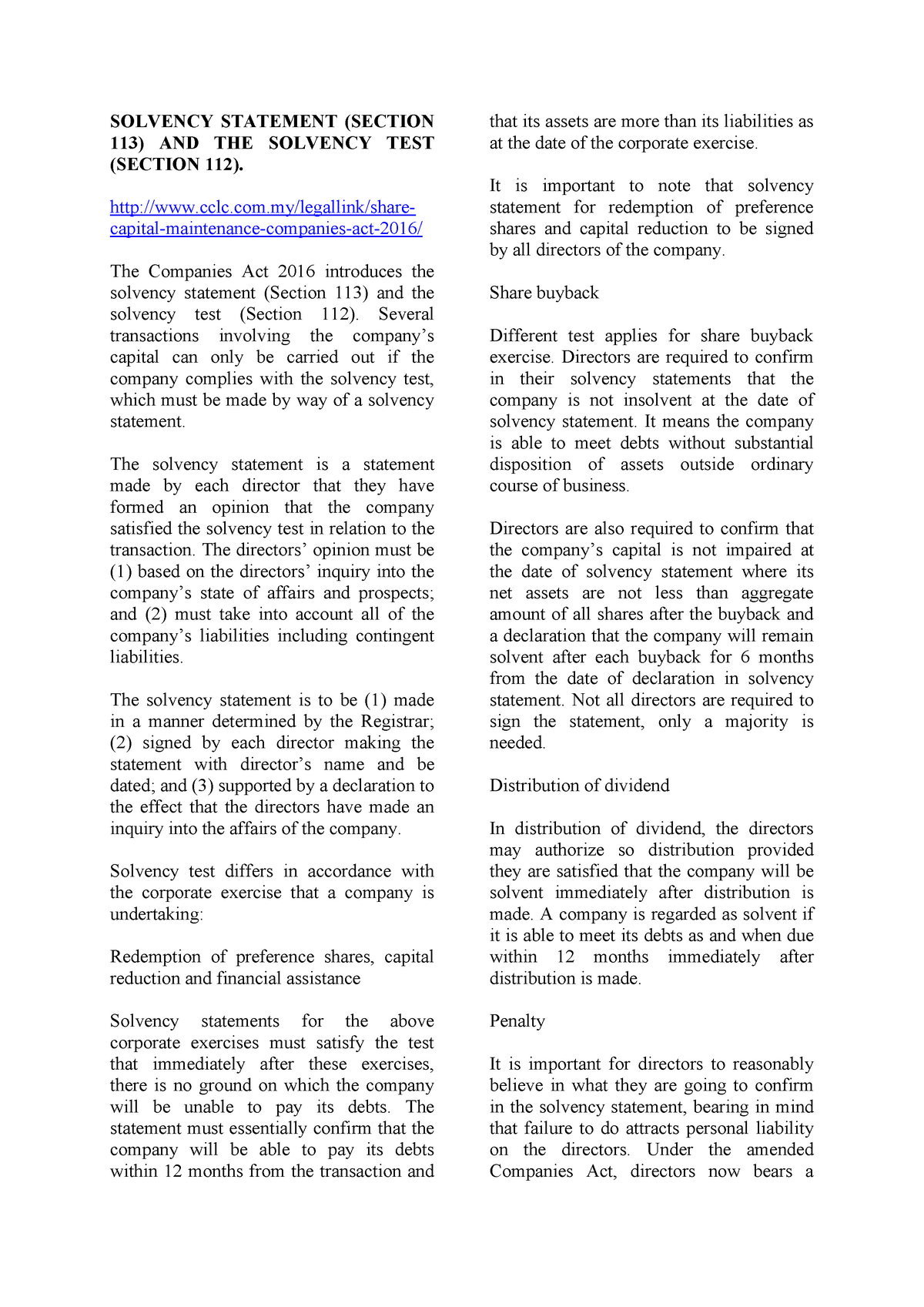

2016- Unclaimed Dividend details as on Jun 16 2017- Unclaimed Dividend details as on Jun 15 2018. SECTION 123 TO 127 OF COMPANIES ACT 2013 READ WITH THE COMPANIES DECLARATION AND PAYMENT OF DIVIDEND RULES 2014. Chapter V Prudential Regulations.

Newspaper Advertisement for Notice of declaration of first interim dividend and record date. An Act to reform company law and restate the greater part of the enactments relating to companies. Companies Incorporation Amendment Rules 2016.

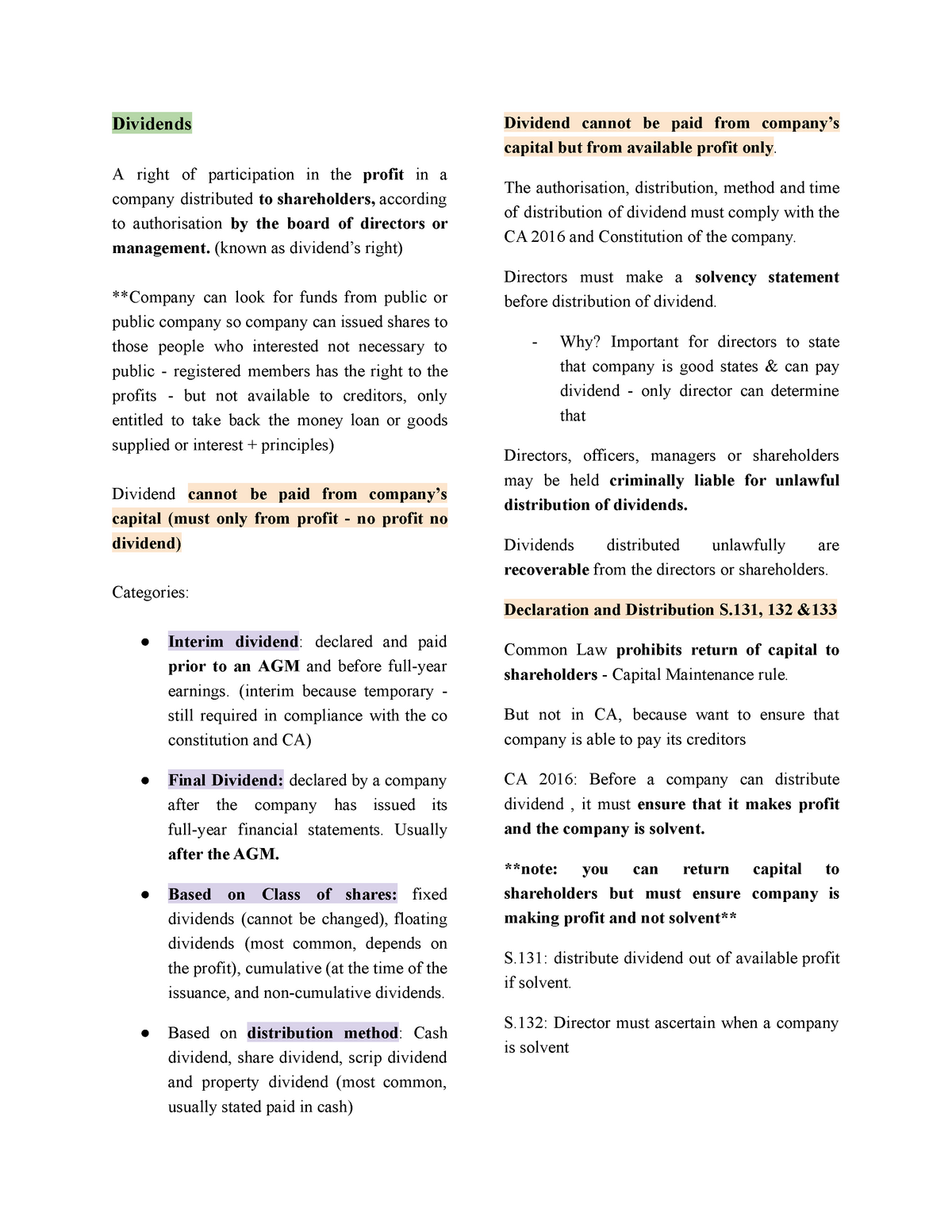

In the CA 2016 the dividend rule is found in s131. It has two principles ie 1 the dividend is to be paid out of the companys profits. PC-Biz includes the most current text of all overtures and reports that will be considered by the assembly.

Rule 1 to 3. Refer Chapter VIII of the Companies Act 2013 from Sections 123 to 127 and the Companies Declaration and Payment of Dividend Rules 2014 for provisions on Declaration and Payment of Dividend. Chapter VIII The Companies Declaration and Payment of Dividend Rules 2014.

Application of insolvency rules in winding up of insolvent companies Omitted wef. Act A15042016 Section 23B. The Companies Significant Beneficial Owners Rules20l8.

Templates of shareholders resolution for declaration of. The Companies Declaration and Payment of Dividend Amendment Rules 2014 - Notification for the Official Liquidator at Hyderabad having territorial jurisdiction in the whole. Prudential Regulations shall be applicable to CIC as defined in clause viii of sub-para 1 of paragraph 3 of these Directions.

From one AGM to the next AGM. In most companies the company directors must hold a board meeting to officially declare interim dividends. An Act to consolidate and amend the laws relating to reorganisation and insolvency resolution of corporate persons partnership firms and individuals in a time bound manner for maximisation of value of assets of such persons to.

Appointment of auditor of a public company under The Companies Act 2016. The Insolvency and Bankruptcy Code 2016. 42 Yield 0602 AM CSX CSX PT Raised to 36 at Evercore ISI 0601 AM Alaska Air Group ALK Tops Q2 EPS by 24c.

Functions of Shariah Advisory Committee. To issue a final dividend shareholders must grant their approval by passing an ordinary resolution at a general meeting or in writing. NCLT related provisions under the Companies Act 2013.

Resignation of auditor under The Companies Act 2016. Resignation takes effect after twenty-one days or from the date as may be specified in the notice. Act A15042016 At or after the end of the financial year being the 31st December of each year the Board shall with the approval of the Minister.

There are two types of dividends interim and final. Dividend As per Section 235 of Companies Act 2013 defines the term as including any interim dividend. DIVIDEND- SECTION 235 Where in simple words dividend can be defined as the sum of money paid by a company to its shareholders out of the profits made by a company if so authorised by its articles in.

Pursuant to the applicable provisions of the Companies Act 2013 and the provisions of Investor Education and. Everything you need to participate in the 225th General Assembly 2022 can be found on this Information Hub page. And 2 the dividend should not be paid if the payment will cause the.

Rule 1 to 8. To amend Part 9 of the Enterprise Act 2002. Declaration of dividend Subs.

Notice inviting comments on the draft rules wrt. To provide loans to any company incorporated under the Companies Act 1965 Act 125. The outside liabilities of a CIC shall at no point of time exceed 25 times its Adjusted Net Worth as on the date of the last audited balance sheet as at the end of the financial year.

Ca 2016 Company Act Malaysian Companies Act 2016 An Overview Minimum Number Of Members Section Studocu

Ca 2016 Company Act Malaysian Companies Act 2016 An Overview Minimum Number Of Members Section Studocu

Declaration Of Interim Dividend By Private Limited Company Indiafilings

Solvency Statement Notes From Articles Solvency Statement Section 113 And The Solvency Test Studocu

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

What Is A Dividend The Complete Guide Oliver Elliot

Company Law Dividend Dividends A Right Of Participation In The Profit In A Company Distributed To Studocu

The Malaysian Companies Act 2016

Format Of Board Resolution For Recommendation Of Dividend

_bill_2016_1510037412_19196-17.jpg)

Company Bill Powerpoint Slides

Procedure For Declaration Of Interim Dividend Lawrbit

:max_bytes(150000):strip_icc()/dotdash_final_Dividend_Signaling_Jan_2021-02-0a09770c2e2b4ca7bd821bf6eb82c48c.jpg)